Once you go into Angel investing there will be an abundance of cases coming your way. Your job as an Angel is to find the right ones and put your energy and money there.

Your ratio of investments to screened cases should be around 1 to 50 if you have a quality deal flow. Higher quality can be obtained by being part of a network that does pre-screening. If you are just evaluating cases from random people approaching you on LinkedIn you will probably end up with a ratio of 1 to 100. Get used to saying no.

In this article series, we will look at the important factors to keep in mind when evaluating startups’ potential to succeed and what level you should put the bar of success at. What we will not cover in this series is if the investment opportunity is correctly priced. Valuation of startups is as much an art form as science and furthermore, the valuations shift quite a lot depending on the economy.

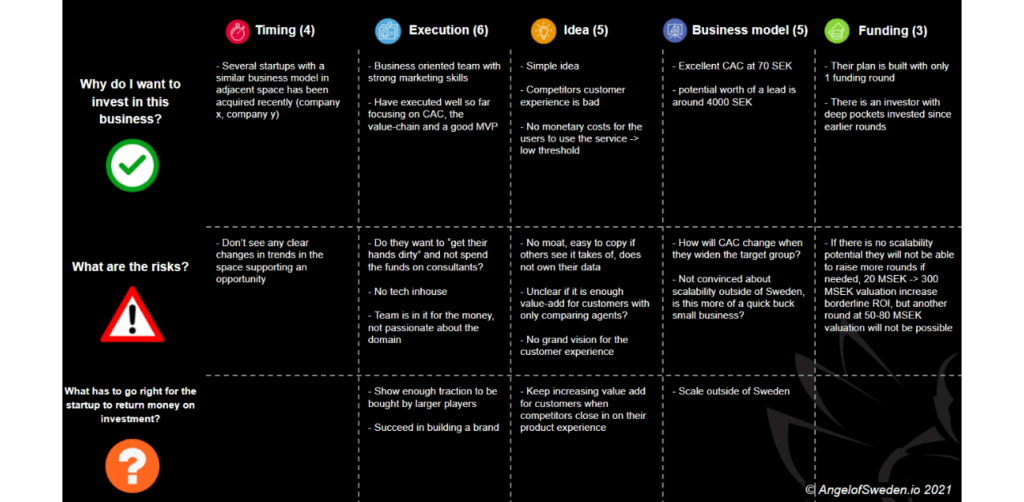

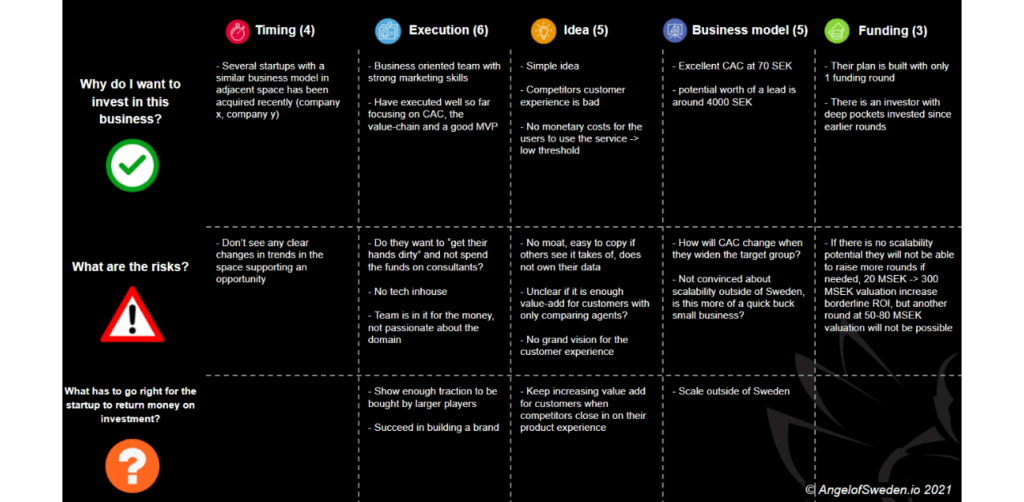

We will emphasize the importance of structuring your thoughts during the evaluation process. To help facilitate the process I recommend using a deal memo. You will have the opportunity to download a template that I created and am using myself. All you have to do is sign up for my newsletter!

Angel investing is investing in innovation

Before we dive into the details we need to understand something fundamental about innovation. There is a difference between invention and innovation. The invention is coming up with something new. Innovation is putting that invention to use. Do you see the difference? You can use a tool like IPScreener to make a search in the patent databases and you will find a lot of inventions that never were put to use.

A patent for a bird-trap and cat-feeder device was filed in the 70s. Fortunately, it never got commercialized.

Usually, when people think about innovation they think about product innovation. One example could be the iPhone. But a lot of successful innovation is done on business models and processes.

Breakthroughs in science and innovation are black swans

One thing complicating the life of investors in innovation is that breakthroughs in science and innovation are black swans. The term black swan was coined by Nassim Nicholas Taleb in his book “The Black Swan” and means we can not predict them. It’s an unknown unknown. Pretty disheartening right? How are we supposed to do well as Angels if we have no chance of picking the winning opportunities?

Have no fear, in the rest of the article, I will walk you through the features distinguishing a good opportunity from a bad one. As I will show you, it’s not about guessing if a certain idea will be the next big thing but more about understanding trends, market conditions, and the team’s ability to execute.

When angel investing, only evaluate cases with unicorn potential

Before we start going through the different aspects of a startup that is outlined in the deal memo template I want to emphasize that far from all businesses are an angel- and venture capital compatible. According to the article “Where Startup Funding Really Comes From” in the Entrepreneur less than 1% of new companies raise angel or VC capital. The article is from 2013 and shows numbers for the US market but it’s safe to say the general idea still holds.

This is important to keep in mind since the startup scene is really hot now in the media and the valuations of companies are high. Some examples of non-VC-compatible businesses are restaurants, consultancy companies, and lifestyle businesses such as photographers or gyms.

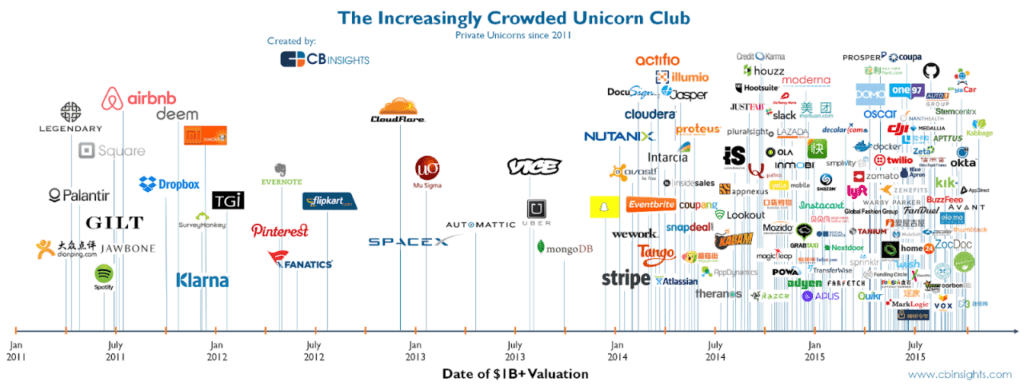

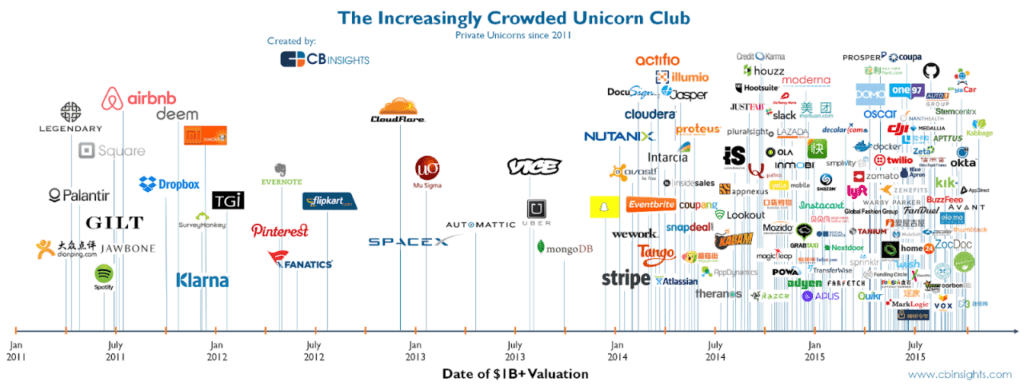

What you want is businesses with unicorn valuation potential. Basically, it means the ability to scale fast and reach a valuation of over one billion USD. The term unicorn has been around for a while but now another mythological horse has been added to the vocabulary. The Pegasus!

A Pegasus company is one that manages to establish a strong revenue stream early and soars to the skies skipping multiple funding rounds. Hence the equity of the founders and early investors perseveres. Jason Calacanis coined the term and elaborates on some of his Pegasus investments such as Calm.com in the article “The Pegasus Startup: Flying Over VCs on the Wings of Profits”.

In short, you want to look closer if you think the case has the potential to give you an ROI (Return On Investment) of at least 25. Preferably the potential upside should be even higher with a 100x potential. That means that if they have a valuation of 100 MSEK when you enter, the valuation at an exit should be at least 2 500 MSEK. Once again Jason Calacanis has written good stuff about this in his book “Angel” as well as on his blog.

Use a deal memo to approach angel investing opportunities systematically

But how do you know if your case has this potential and could there be other reasons than pure financial upside in an exit for you to invest in an opportunity? In the next two articles, I will walk through the aspects that are the most important. You will be able to use these aspects to systematically break down a case and evaluate it. Feel free to take a sneak peek at the aspects in the template available at the top of this article if you are too eager to wait.

In my article “How To Get Comfortable With The Investment Process” I outline my investment process. Using the aspects covered in this article series are mostly applicable to the Screening, Pitch, and Due Diligence steps. I suggest you use a deal memo to keep yourself honest. It will force you to articulate your thoughts and engage your system 2 thinking which Daniel Kahneman articulated in his book “Thinking, Fast and Slow”. Don’t let your emotions guide your investment decisions! You can also go back later and check how your thinking process went when there is a new round coming up.

A deal memo is also possible to share with other investors in case you want to bring them on board in a round. Just be careful to not share confidential information without checking with the founders.

Distinguish between general and personal reasons to invest

Before we jump into the aspects of a case I want to say a few words about other reasons to invest in opportunities. The general reasons are things that make the case investable for anyone, great timing, great team, and so on. Basically, things apply to anyone who has got a bag of money.

But there are usually personal reasons to invest in a case on top of the general ones. Things that only apply to your specific situation. Some of these could be:

- Want to understand a space/market better

- Finding a potential team to join later in an operational role

- Potential to consult for the company

- Network with other investors

- Philanthropic reasons

- Helping family or friends

These reasons could strengthen a case enough to tip the scale from a pass to a yes. However, I would not use them as a sole basis to make an investment. The foundation needs to be there. We already talked about what the economic targets need to be, x25+ ROI. We will soon look at the foundation needed to succeed as a startup in terms of the specific aspects but before that let’s talk about the investment opportunity itself.

The current valuation is an equally important factor as the quality of the startup itself

When deciding on participating in a round you also need to take the price (valuation) into account. Even if the startup ticks all the boxes to be the next unicorn the valuation might be too high. The valuation influences your upside as well as the risk you are taking. Think of it like this: If I offered you to buy an apartment in the best location in the city you would not know if it was a good deal unless you knew you got it for a good price.

There is no easy way to determine if a valuation is fair in startups. Traditional valuation models for companies are often based on current and future cash flow as well as assets held by the company. In a startup, there is no such data or assets.

If you are just starting out with Angel Investing I suggest using the oldest trick in the book to get an idea of whether the valuation is fair. The price of an item is worth what others are prepared to pay for it. If there are no other investors in the round don’t be the first one in. Also, look at who the other investors are. Family and friends do not inspire the same confidence as professionals.

Conclusion

First, you need to understand that it is almost impossible to foresee what ideas will revolutionize an industry. Innovations are true black swans.

Secondly, you need to understand yourself and your motivations for investing in startups. When looking at an opportunity you need to know if your reasons to invest are general or if you have personal reasons.

Thirdly, the financial upside needs to be there to make the business opportunity attractive. Look for the potential of the two mythological horses: the Unicorn and the Pegasus. If the potential valuation in the future is not more than one billion dollars the risk is usually not worth it.

And lastly, I recommend you write down your thoughts on the cases in a structured manner. Make sure to keep yourself honest. Feel free to use the deal memo template I provide at the start of this article.

Find out how to apply the first two aspects Timing and Execution in part 2 or skip directly to part 3 to read about the Idea, Business Models, and Funding aspects.