We are now ready to take a look at the model you can use to evaluate the potential of a startup. The model is built around five factors and in this article, we will go through the first two factors, Timing and Execution / Team in detail.

In part 1 of this series, we put out some ground rules when evaluating a potential angel investing case. We talked about the need for a large upside in valuation as well as the need to have a structure when evaluating an opportunity.

The five success factors of an angel investing case

There are a lot of ways to dissect a startup’s potential and it’s not how you pull it apart that is the most important but rather that you take a closer look. You need to apply your “slow thinking”, or system 2 thinking, as Daniel Kahneman writes about in his book “Thinking, Fast and Slow”.

Just going on your gut feeling will open you up to biased decision-making. You don’t want to make an investment decision based on the unconscious fact that you just had your morning coffee!

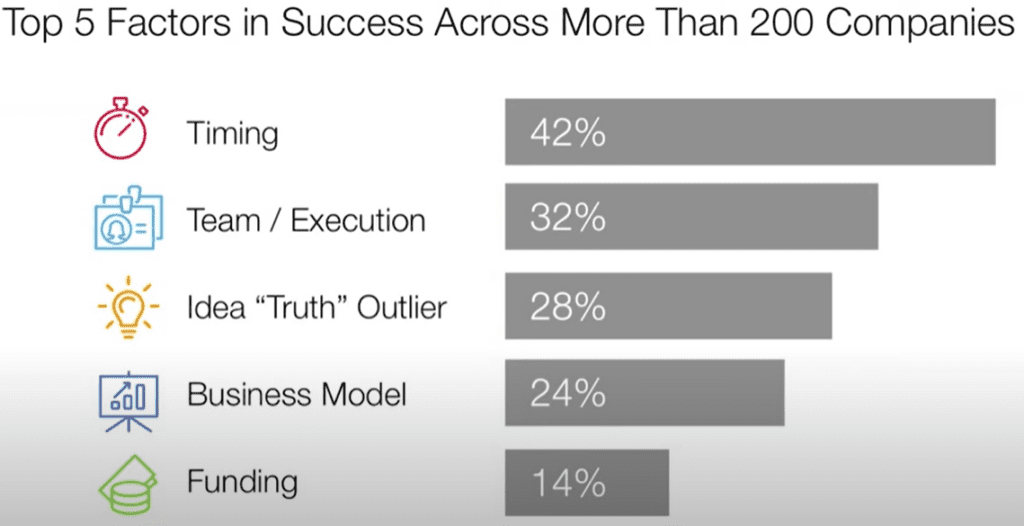

The factors we will use to assess an opportunity come from Bill Gross at Idea Labs. In his excellent TED talk titled ”The single biggest reason why startups succeed”, he elaborates on his analysis of this subject. The factors in the model are Idea, Execution / Team, Business Model, Timing, and Funding.

Let’s take a closer look at Bill’s work before diving into examples of the factors. At first, Bill thought the idea was most important. He had so much belief in this that he named his incubator “Idea Lab”. But taking a closer look at some startups painted another picture.

The execution/team factor (light blue icon) being important is probably not a surprise to anyone. We hear this all the time. But what was surprising was the importance of the timing factor (red icon) being the key in 42% of the startups examined.

Also, the fact that the business model comes in second to last place is interesting. As investors, we always talk about the need for a scalable business model. But now it turns out this factor is almost the least important factor. What is going on here? Let’s put a mental note here and return to this in the last article in this series.

The way to interpret this is that if you find a startup that is spot on in the global trends and it has the right team to tinker in this space you will have a high chance of making it.

It is ok for the business model to take some time to materialize. If they are in the right place with the right people and processes they will be able to roll the dice many times putting the odds in your favor to strike gold.

These factors are the basis of the template you can download for free at the top of this article together with some evocative questions. Let’s now have a look at the factors one by one and what they mean.

Timing – Are all the stars aligned?

Have you ever heard the expression timing is everything? Well, it’s true! At least to a large extent. An idea can be both too early or too late. It needs to be timed just right.

One reason an idea might be too early for its time is the inertia of human behavior. You might think you are open to change, but you really are not. At least if you are like the vast majority of the population. This survey showed that only 38% of the respondents are positive to change.

This is important because buying a new product or service is the result of changing your behavior and for a startup to be successful you need customers.

Let’s look closer at an example of a company that was too early for its time. Webvan was started in 1996 and delivered groceries to your doorstep within 30 minutes. Does this idea sound familiar to you? I bet it does. Since Webvan was so early you would think they would be market leaders by now? Wrong, they filed for bankruptcy in 2001. The market was not ready to adopt ordering online.

Some timing aspects to take into consideration are:

- Is the market segment growing? – There is no reason to swim against the current. You want the idea to be in a fast-growing market. Look at the CAGR (Compound Annual Growth Rate) to get an idea of the trend. This is where the action is.

- What does the competitive landscape look like? – Having some competitors is actually a good thing. Together they will put their message higher on the agenda of the customers. What you do not want is a single dominating player (unless it’s you) as this will make it super hard to attract customers.

- Is the technology landscape shifting? – Just imagine what was made possible when electricity or the Internet was invented. More recently we have seen advances in large data processing capabilities made available through cloud computing spurring innovation in AI. Other areas could be new materials being invented or the adoption of cell phones with cameras and high-speed networks.

- Is the regulatory landscape changing? – Maybe the EU just put a new law or regulation in place. I bet some interesting ideas came up when GDPR was announced.

- What are the global trends in society? – Have a look at the news outlets to understand what the topics are. But be aware that you will be looking at the trends through the lens of the editors of that news outlet. And they are no oracles. Don’t make the mistake of thinking that your favorite channel on TV is reporting an objective balanced view of what is going on in the world.

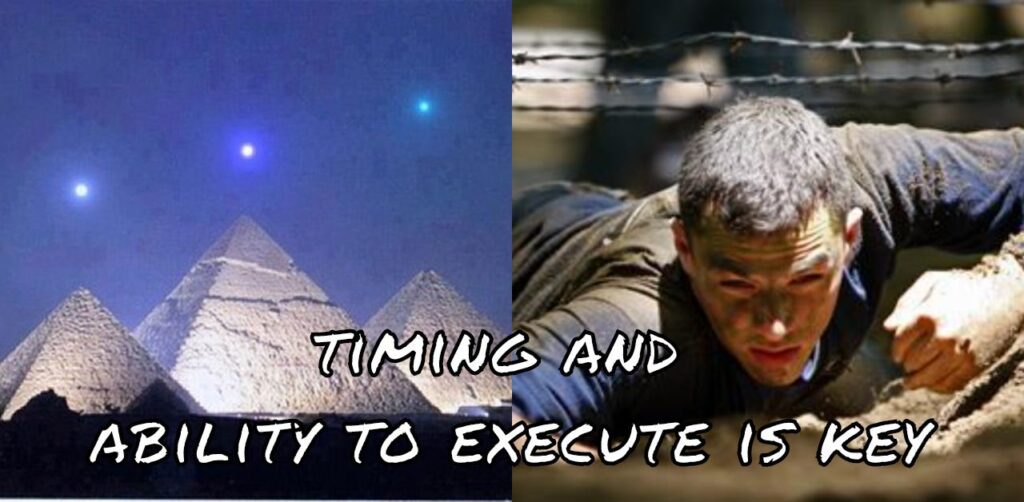

Team and Execution – Capabilities and passion to make it happen

The phrase “Ideas are a dime a dozen. People who implement them are priceless.” says it all. But the hard part is to understand if the team is actually the kind of people who get things done. If you know them well personally you probably have an idea of what they are capable of, but how can you assess this in a new acquaintance in a few hours of meetings?

When you think of it, it actually resembles a recruitment process. You want to bring on board the brightest and most productive people to work with you.

First of all, you should look for motivation and passion in the team. Why do they want to build this thing? Is it because they want to make a lot of money? Do they want to be their own boss? If these are key drivers you should be careful since they might jump ship to another idea when things get tough. There are easier ways to make money than starting a company. And things will get tough, you can be sure of that.

During your meetings, you should take a look at the track record of the team. You can look both at the current company and past achievements. Some people are great at talking, but can they walk the walk? Let them prove it by showing important milestones met so far as well as what they have done before this venture. Yesterday’s weather is the most likely weather today, the same goes for deliveries of people and teams.

What you are looking for is a company that seems to have legs. If it has taken several years to put an MVP (Minimum Viable Product) in the hands of some users it will probably take many more to achieve some measure of sales. Not a very good sign for the future.

Ideas are a dime a dozen. People who implement them are priceless.

Mary Kay Ash

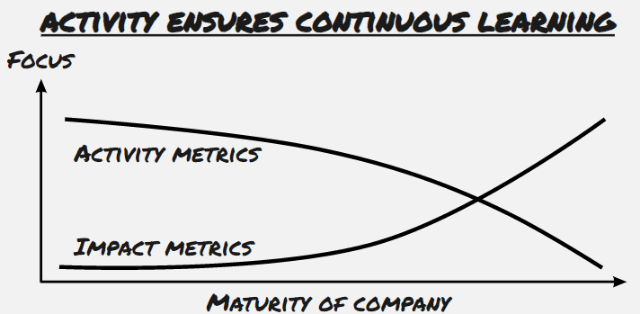

You also want a team that does the right things. Not just working hard. You want to see they have gotten as many touchpoints as possible with the market. Market surveys, customer/industry experts interviews, pilots using and paying for the product, advisors, and investors committed, grants paid out and admittance to incubators are all signs of traction.

But remember, the ultimate proof of traction is paying customers. Especially if the team claims they have reached product-market fit and are ready to scale.

The team needs to be committed, one way to validate this is to make sure the Co-founder / Shareholder agreement contains a dedication clause. Basically saying the key people will commit 100% of their business time to the company.

It should also be clear on the cap table that the key people own the majority of the shares in the company and that they are vested over a time period of at least three, preferably four years. Vesting means that if they leave the company they will have to sell all or a part of their shares to the rest of the team.

Be wary of large positions on the cap table owned by passive investors or incubators. A rule of thumb is double-digit percentages. You want the team to have as much skin in the game as possible.

Key people means the people with the competencies needed to execute on the core of the business. If they are building a digital product, they need a developer. If they are building a B2C product involving a lot of marketing it’s a marketing expert. You get the idea.

The team also needs someone to sell it. It means convincing people to invest in your company, join as a member, or buy the product as a customer.

Conclusion

Approaching the assessment of a startup in a structured way will increase the chances you make a sound decision. Feel free to download the template I provide at the top of this article.

It’s easier than you think to let your mood dictate your decisions. It might be fine to do so when deciding on which toothpaste to buy but if you handle your investment decision this way you might end up in a bad spot.

Out of the five aspects of startup success that Bill Cross laid out, Timing and Execution are the two most important ones.

The timing factor can be the make-it-or-break-it for a startup. They need to be just right, not too early, not too late. Changing the behavior of a customer needs to be driven by something more than a slightly lower price / better product.

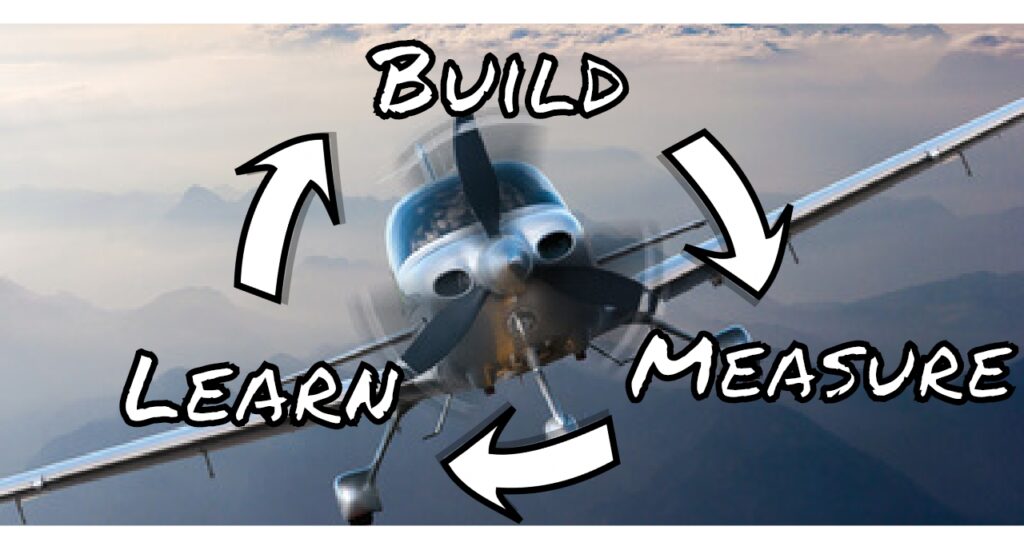

Execution is everything. The competition will be fierce and the best way to defend the business is often to just keep one step ahead. The team needs to do the right activities as well as a lot of them. The iteration loop with the customers should be rotating faster than a propeller on an airplane.

If the team can make that happen they will be able to take off into the skies with their business, hopefully with you onboard!

Be sure to check out part 1 of this series if you have not done so already or read part 3 now.