In this post, I will walk you through my investment process and its steps. Every investor has their own and all cases are a bit different. I know investors who are mostly going on their gut feeling while I tend to take a more structured and analytical approach.

I treat the process almost like a sales process where you build a pipeline. It’s easy to spend a lot of time on cases that lead to nowhere as entrepreneurs can be quite convincing in asking you to take yet another meeting. It’s important to know how to qualify the cases early to not waste your and the founders’ time.

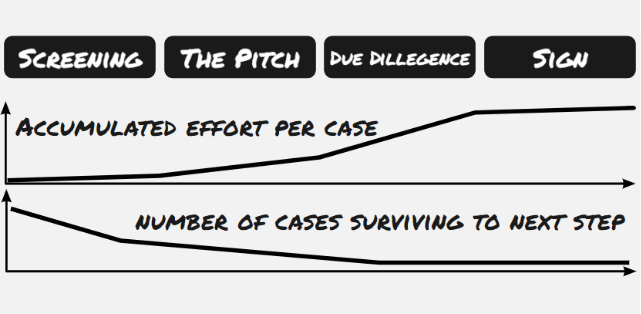

Sticking to this process will enable you to make 20+ investments per year providing you have a decent deal flow. The steps are Screening, The Pitch, Due Diligence, and Signing. I will go through each step on a high level since going into details would warrant at least one post each. Let’s get to it!

- Screening: Is this case a good match?

- The pitch: Will this team build the next unicorn?

- Due Diligence: Fact-check the claims of the team

- Sign: Seal the deal as the final step in the investment process

- Make sure you don’t make rushed decisions in your investment process

Screening: Is this case a good match?

Investment cases will come through different channels. It can be direct approaches from founders via LinkedIn or email, recommendations from other investors in your network, or maybe you have been attending pitch events. You also have the option to scout freely on your own and approach startups you think are interesting.

Far from all cases will warrant taking a meeting. In his book “Angel: How to invest in technology startups”, Jason Calacanis outlines what he thinks needs to be in place. I think he provides an excellent baseline and I suggest you find your own criteria based on your investment strategy.

Some of the things I consider before taking a meeting are:

- Is this space growing?

- Does the team look strong?

- Do I think they are solving a real problem?

- Do they have some traction, preferably pilots or paying customers?

- Is this my space and type of business and do I see how I can make a valuable contribution?

You always want to see a full pitch deck before you commit to a meeting. Elevator pitches are great to peak your interest but it’s not enough. Some founders have tried to tease me with fluffy management summaries to lure me into taking a meeting but this is just annoying in my opinion. A startup raising money needs to have a pitch deck. Ask for it in advance so you can read up and not waste the time of the first meeting going through it in detail.

Be prepared to reject at least 80% of cases right at this stage. It will save you a lot of time. In total, you should not spend more than about 20 minutes at this stage per case. Usually significantly less. If you think it could be an interesting case but lack information ask for clarifications over email.

If the case seems interesting you should qualify if you are the right type of investor for them. Email them an introduction and state your ticket size and what your contribution would be if you invest. It’s good to get this communicated as early as possible to weed out bad fits.

Make a one-liner note for the case in a spreadsheet. This will provide a good reference in the future as it will help you to calibrate your skills on which cases to proceed with. Your memory tends to not be very trustworthy as you can read more about in the article “Creating False Memories” in Scientific American. It’s called hindsight bias.

The pitch: Will this team build the next unicorn?

This is probably the first time you meet the founder in person (or over video). Take some time to break the ice and get to know each other. Create a comfortable atmosphere. Be humble. It will help to have an honest dialog. Ask about how they came up with the idea and why they want to build this company.

During this meeting, you should focus on the most important parts that could break the case. Some things to consider are:

- Why is now the right time for this opportunity?

- Why is this team the right one to build a unicorn?

- Is the cap table investable or is it carrying a lot of dead equity?

- What is their traction so far? Pilots, customers, grants, raised rounds?

- What about this round? How much are they raising? What commitments do they have from other investors?

- What are they looking for in their investors? This is where you need to talk about what contributions you can make except your money. Make sure to check out my article “Access Exciting Opportunities By Understanding Your Investor Profile” on this topic.

Ask a lot of open-ended questions. They usually start with “Why”, “What”, and ”How”. Ask follow-up questions. It’s where you find the good parts. Make sure to not create a feeling of you interrogating the team. It will just make the future relationship complicated. But at the same time, if something is not clear, dig deeper!

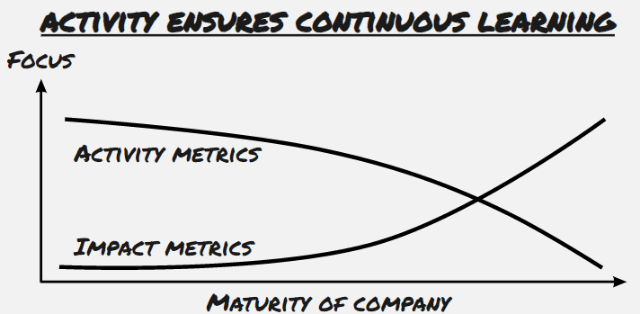

The founder should be able to share a good picture of what their biggest challenges are right now and what assumptions they have made. Their focus at the early stages should be to learn as much as possible with experiments. What you are looking for is if they are moving fast with the right activities.

If possible it’s a great idea to team up with some other investors to have a joint meeting. It will save time for the team and you will have someone to compare notes with. Preferably you should set aside 15-30 minutes directly after the meeting to discuss.

Update your one-liner with another one or two sentences for future reference. Take some time to think over the case. Ask around in your network about opinions. Then get back to the team with what you think. Be prepared to reject at least half of the cases at this stage.

Due Diligence: Fact-check the claims of the team

Founders tend to be optimistic and live in a distorted reality. They have to. The process of building a business is full of hardships. Sometimes they exaggerate their traction or the opportunities of the space. I’ve noticed that almost all founders think their idea is the best idea since sliced bread.

It is your job as an investor to look through the pink clouds and the rosy picture that has been painted. You need to ask the hard questions now and make the founders back them up with proof. This part takes some courage if you are not wired with this personality in the first place.

I recommend you compose a deal memo for yourself to structure your thoughts. In the article “How To Spot Great Angel Investing Cases (Part 1)” I share my own template with you and elaborate more in detail on what to look at.

Do some analysis of their market space on your own. Spend 30 minutes browsing the news for trends. Looking for competitors that have raised money and compare their value proposition to your case.

Ask for access to the data room. If other serious investors or institutional investors such as Almi Invest are involved they will also request this. A data room can be a google drive where important documents are collected such as:

- Detailed financial plan containing broken-down costs and projected revenue and sales in the coming years.

- Draft of the Shareholder Agreement that you will be signing. You should read this and suggest amendments.

- A Co-founder Agreement or previous shareholder agreement.

- Capitalization table showing current owners and their control over the company.

- Customer and supplier contracts make sure their traction is what they say and that strategic partnerships needed are in place.

- Product roadmap describing what development milestones need to be met by when to secure the success of the business.

You should also do at least one reference call, preferably two. A 30 minutes call with a customer is a must, ask for an introduction from the team. You could also talk to previous investors and strategic partners. If you have other trusted parties in the investment process it’s enough to take part in their summary of the call.

Take another meeting with the team. Ask them to clarify the questions that have popped up. Some investors like to send a list of questions in advance but I have mixed feelings about this. It tends to become a long presentation reading pre-written answers instead of a conversation.

In total, you allocate 4 hours in total for this step. Sometimes it takes longer, but it should be possible to do decent Due Diligence within that timeframe if you team up with some other investors. A little less than half of the cases should turn out to be not investable at the Due Diligence stage.

Sign: Seal the deal as the final step in the investment process

Nowadays, at last here in Sweden, the signing is done digitally. There are services like Zigned that provides digital signing of documents for around 10 SEK / document.

If you are participating in a fixed equity round you should be signing an Invitation to Subscription (teckningssedel in Swedish) stating the number of shares you are buying, for what price, and where the shares are coming from (emission of new shares). But there are also other types of fundraising vehicles such as convertibles. Sometimes you also sign an Investment Agreement regulating the details of the investment round.

A Shareholder Agreement should also be signed by you and all other shareholders. For smaller companies, the record of who owns what shares is kept by the company in their ledger (Aktiebok). Ask for a copy of it for your own reference.

Save all documents together with a copy of their pitch deck. The deck will come in handy when they are raising the next round and you want to assess if the team is delivering according to plan.

Congratulations! You have now transitioned into being part of the team. It’s now your job to do all you can to make sure they succeed. Ask the team how you best can assist!

Make sure you don’t make rushed decisions in your investment process

The time it takes to go from screening to a signed deal can vary from a few weeks to up to six months. It depends on different factors like how good the startup is at actually getting all the investors on board. If you get in contact with the startup late in their investment process you need to speed up your part to be able to participate. But remember to get comfortable with the deal before committing.

Don’t let yourself get rushed by founders telling you this round needs a commitment tomorrow / next week. Personally, I have put up a rule for myself to not make commitments within 24 hours of meeting with the founders. It’s good to get some time to let the whole idea sink in and get some perspective.