When a startup needs more capital they have a few different options. They can take a loan or invite investors to buy into the startup. Taking a loan requires security which a startup does not have. That leaves the option to let investors in by adding funds to the treasure chest. As an investor, you need to understand how your share in the startup will be subject to dilution with every round.

Even more mature companies might also choose to raise money instead of taking a loan. One example of this is Klarna, the Swedish fintech, which you can read more about in the article “Fintech giant Klarna raises $639M at a $45.6B valuation amid ‘massive momentum’ in the US” at TechCrunch.

Offering a stake in the startup to investors could be done in a few different ways

One of the options is to create a convertible. Convertibles come in several forms but I found it is easiest to think about them as a loan with the right to convert the money lent into shares in the future, usually with a discount on the valuation.

Another option is to do a fixed equity round. In this case, the investors buy shares in the startup straight away for a set valuation. What option to choose and the details of it, like valuation and round size, are decided by the board.

You should also be aware that option plans and warrants will create additional shares if exercised and cause a dilution for the current shareholders. The general math of dilution is the same for these. However, in general, the valuation of the startup does not go up when the dilution happens. If you want to understand more about how stock options work you can read “Understanding Startup Stock Options” at Y-Combinator’s site.

In this article, we will be using a spreadsheet I’ve created to calculate how dilution of your share works when rounds are raised and how different conditions affect your ROI (Return on Investment). It is a bit technical but I will walk you through all the math.

Feel free to sign up with your e-mail and you will receive a link to the template to use for your own cases!

Dilution is usually not a problem unless you share exercises control of the startup

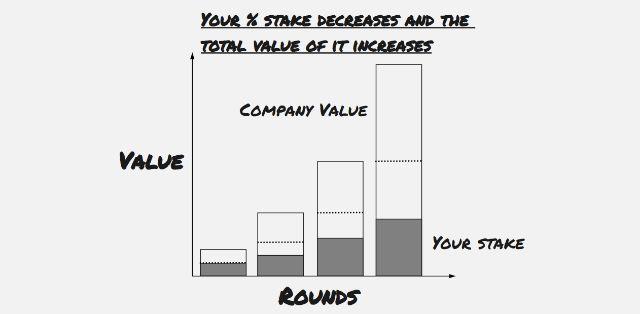

The implications of several rounds of raising money are that you will see your share in the startup being diluted unless you participate with more money. Dilution is probably not a problem if your primary objective is to make more money. New rounds usually mean a higher valuation offsetting the losses of dilution.

But if your share in the startup is connected to having influence over decisions you might see yourself losing control when money is raised. This problem can be offset by introducing different types of stocks with different voting rights.

If you are an angel investor you usually don’t care that much about the control of the startup. In cases when you own a large share of a startup you should be aware of the shareholder agreement which might stipulate thresholds for when you are entitled to a board seat and how decisions in the startup are made.

Calculating dilution in a round and how much you need to invest to stay undiluted in the startup

Now we will dive into a bit of math. If this is too complicated you can always just download the template from the banner at the top of the article.

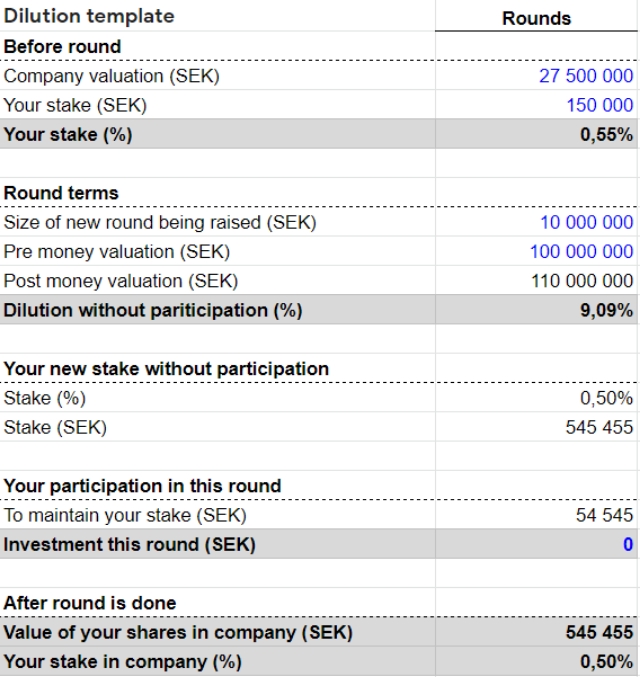

Let’s say you participated in a previous seed round and have put in 150 TSEK at a post-money valuation of 27,5 MSEK. Post-money valuation just means the valuation of the startup after the funds of the current round have been put on the balance sheet. Congratulations, you now own 0.55% of the startup (0,150 MSEK / 27,5 MSEK = 0.55%).

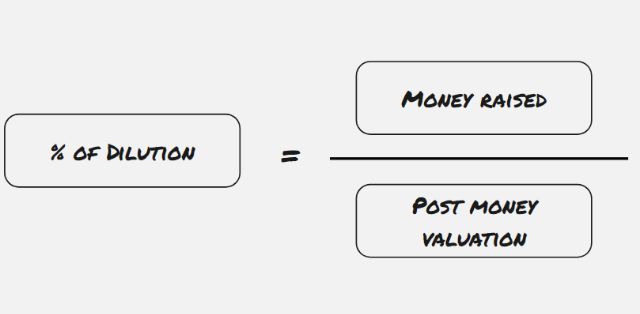

Everything is going smoothly for the startup and they decide to raise another round of 10 MSEK at a post-money valuation of 110 MSEK. You (and all the other shareholders) now face a dilution of your share in the startup by 9.09% (10 / 110 = 0.0909). This will put you on a share of 0.50% of the startup (0.55% – 0.55% * 9.09% = 0.50%).

You might be ok with this dilution as the value of your share has increased from the initial 150 TSEK to 545 TSEK (0.50% * 110 MSEK = 545 TSEK).

But if you think this startup has more growth ahead you might want to defend your share and participate in this round. You might even want to double down and increase your share. To defend your share in this round you need to put in another 54 TSEK which is basically your part of the raised round (10 MSEK * 0.55% = 54 TSEK).

In the spreadsheet, you can see all the numbers. Use the template to play around with some scenarios on your own!

How does shifting the proportions of money raised between rounds affect your returns?

Let’s take another interesting example. What is the impact on the ROI when the funds raised are shifted around between the first and second rounds given that in both cases you enter in the first round? Intuitively your ROI should be higher when the first round is proportionally larger as most of the dilution happens before you enter the cap table.

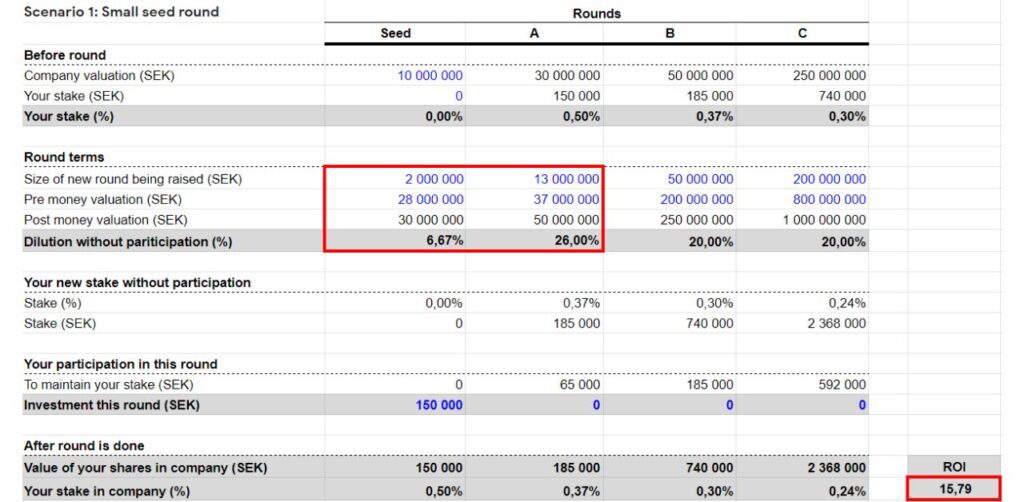

In this comparison, we will be using two scenarios. Here are all the conditions.

- 65 MSEK is raised over three rounds and you make an exit in the fourth round.

- The startup valuation is the same in all the rounds (30 / 50 / 250 / 1 000 MSEK)

- You enter in the first round with the same ticket size in both cases and do not make a follow-up investment.

- In the first scenario, 2 MSEK is raised in the first round and 13 MSEK is raised in the second round.

- In the second scenario, 10 MSEK is raised in the first round and 5 MSEK is raised in the second round.

In both scenarios, 15 MSEK have been raised in the first two rounds. This situation is a bit artificial with such a small second round in scenario 2 but I wanted to keep the total amount raised in the rounds equal.

What are the implications of your ROI? Let’s use the template to find out!

Scenario 1: Small seed round

Scenario 2: Large seed round

As you can see the ROI is almost 16 in the case with the heavy dilution in the second round (scenario 1). If the heavy dilution is happening before you enter the cap table your ROI is slightly above 19 (scenario 2). That is actually a 22% better return on your investment.

In reality, you probably are not able to influence the round size that much. It should be the runway to hit the next milestone needed to raise the next round that should decide on the round size. But it’s good to intuitively know that when the team starts talking about extending the size of the round it is a good thing for you.

Conclusions

There are several things you should take away from this article. One of them is how easy it is to calculate dilution in a round. Just divide the round size by the post-money valuation and you have the %. This can be used to understand how the incentives of key people are affected.

Another takeaway is that you don’t have to defend your share in new rounds unless you are interested in exercising control of the startup. Your returns will come from the increased valuation of the startup.

You could, and should, still make follow-up investments but they should be done based on what you now know about the startup possibilities. Being invested in a startup is the best way to assess its viability of them as an investment case. But this is a topic for another article.

Option plans and warrants given to key people will affect your share through dilution and also the valuation of it negatively from a purely mathematical standpoint. It is still good practice for startups to utilize them though as it makes it easier for startups to retain people.

As always you can contact me if you have any questions about this!