But what does too diluted mean? If less than 50% of equity is not in the hands of the founders after having raised an A-round we are in the danger zone of being too diluted. 50% is more of rule of a thumb than a hard threshold. But it is vital to have assumptions when using a startup equity dilution calculator.

The definition of an A-round is when we are taking in serious capital to scale our operations. We have proven product market fit. With attractive unit economics. It is time for rapid scaling.

Investors worry about founders with diluted equity in their startups because of miss-aligned exit incentives

Investors want to see that we are incentivized. With less equity, we might start to slip into the state when we ask for a market-rate salary. We might be happy to just have our own business and be our own boss. Investors dread this and call it a “lifestyle business”. All of a sudden our incentives are not aligning about what an exit would look like.

An exit is the reason that startups can attract venture capital. Investors look for scalable startups and can still go unicorn. This makes a startup able to be valued at around 10x the ARR (Annual Recurring Revenue). If the conditions are right. Conditions such as good growth rates and a strong economy with plenty of cash to go around.

A good growth rate is defined as at least 6-7% month over month, preferably in the range of 10-20%. Comparing this to a lifestyle business which is valued at around 5x the profits when a PE (Private Equity) company is buying them. That difference is huge. We could never defend having even a €1M valuation on an early-stage startup that will become a lifestyle business getting sold 10 years from now.

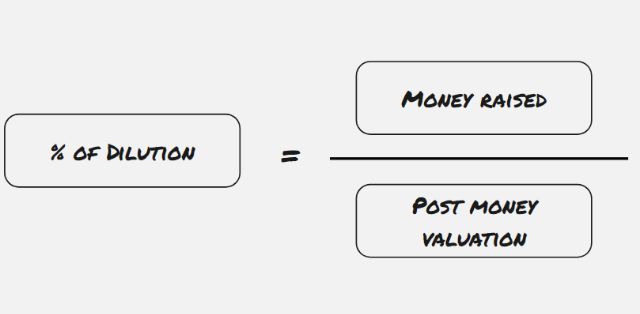

Calculating startup equity dilution in a round is simple

Let’s start from the beginning to understand the ropes of the calculations needed to plan the funding journey. For one single round of funding, you can use the simple formula below.

Example 1: We are raising €0.1M at a €1M post-money valuation. What is the dilution for current owners?

Answer: 0.1 / 1 = 10%

Example 2: We want to dilute 10% in this round and need to raise €0.2M to reach our next milestone. What will be our post-money valuation?

Answer: 0.2 / 0.10 = €2M

This was probably not too complicated. But only looking at one funding round ahead is not enough. We need to have a more long-term strategy than this. To better illustrate a few different situations, let’s look at a few examples using the free template you can download on top of this page.

Planning the funding journey with the startup equity dilution calculator

In all these scenarios we assume the founders own 100%. This is not always the case. Every startup is unique and has its own history. And becoming diluted from the start is making it harder for us in the future.

The startup can be a spin-off from a previous company retaining a large piece of equity from that transaction. Or have passive cofounders because there was no vesting schedule in place. Or a Venture Builder has been involved in building an MVP.

We should not be too discouraged if we are already diluted from the start. Model out the future rounds and create a strategy to make it work!

Let’s dive into the scenarios.

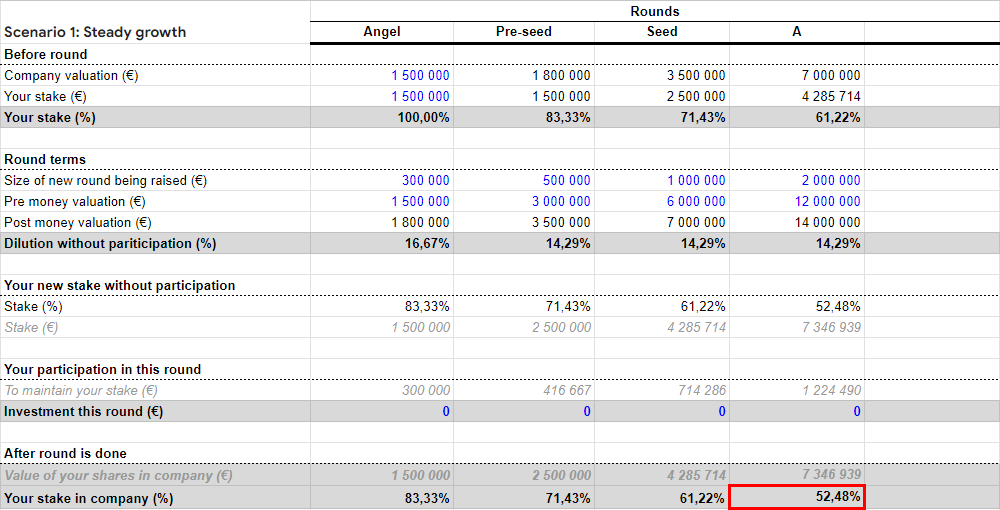

Scenario 1: Steady growth when all goes according to plan

This should never be how we plan our funding journey. It leaves no room for error. Which is very unlikely. Even if we execute perfectly, the circumstances around us might not be in our favor. But let’s start with this scenario to understand the basic math.

Here we start with 100% equity in the startup, we raise an Angel round at a €1.5M pre-money valuation and then proceed with doubling the pre-money valuation each round until we have raised an A-round. We focus on the important activities for a startup of this stage:

- Assembling a team with all the core competencies need to build a put your product in the hands of your customers

- Getting the first users of our product, conducting user interviews, and gathering customer requirements.

- Validating the unit economics, willingness to pay, and having a product that sticks with our customers.

We raise our A-round and are ready to start scaling fast. According to the startup equity dilution calculator we got here maintaining 52% equity of the company. Great! Investors will be pleased.

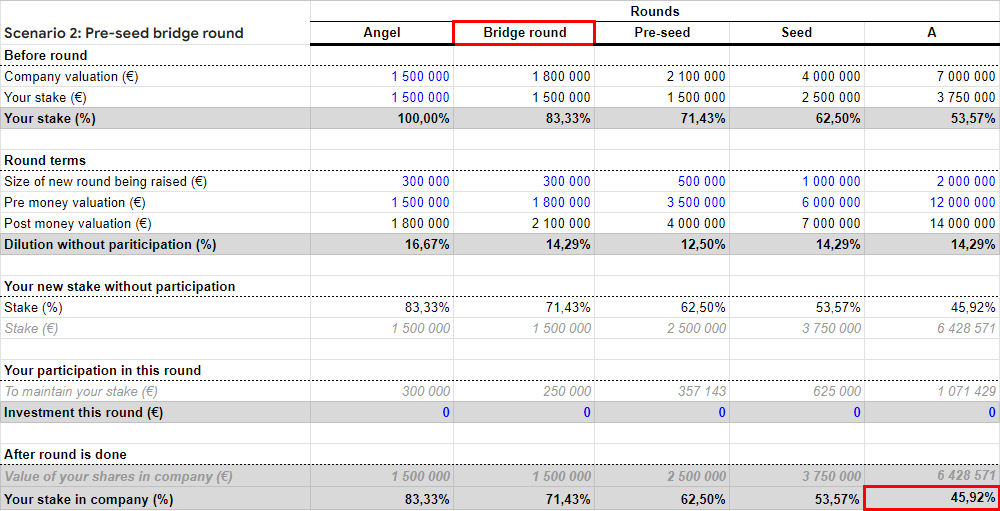

Scenario 2: Bridge round between the angel round and the pre-seed round

This is a pretty common scenario. I’ve seen it happen over and over again in startups. We don’t hit our milestones and can not justify a valuation increase to our investors. But we still need more money as our runway is almost up from the previous round. We then raise a bridge round. Putting the pre-money valuation at approximately the same valuation as the previous round’s post-money valuation.

Bridge rounds are pretty common. And we can usually afford one or two, depending on the cap table conditions. To know if we can afford a bridge round we should create a model. We can use a startup equity dilution calculator to look ahead and see how our equity will change with consecutive rounds.

In this scenario, we end up with 46% equity in the startup for the founders after the A-round. Many investors will think this is not enough, and we might run into trouble raising the scaling money in the A-round.

What can we do to avoid this?

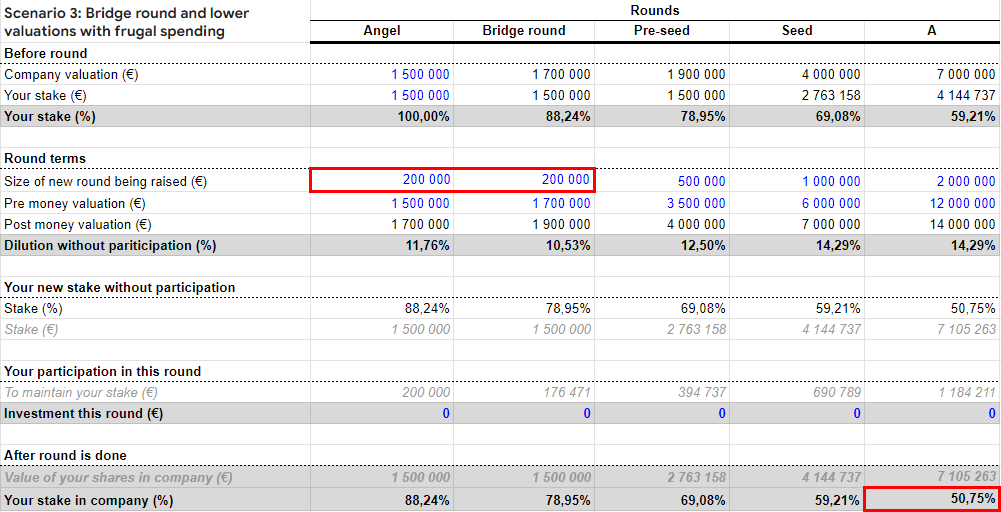

Scenario 3: Being frugal to be able to afford to raise a bridge round

In this scenario, we raise €0.1M less in the Angel round and in the bridge round. But how can we achieve the same results with less funding? Every case is unique, but here are a few general tips:

- Make sure our team does not rely on expensive consultants to build our product. Avoid startup builders and studios working for SWEAT-equity, see my previous article “Venture Builder: The vampire of the startup ecosystem”.

- Make every euro count. Don’t sign up for every flashy SaaS tool you can find.

- Don’t spend money on paid marketing to grow your user base. Paid marketing is only ok to validate ideas until you reach the scaling stage.

In this scenario, we end up with 51% equity in the startup for the founders after the A-round. A very close call if we put the cut-off at 50%.

A runway is established as soon as investors enter the cap table

The clock starts ticking as soon as we onboard investors. It is ticking because we raised money since we don’t have enough resources ourselves. If we didn’t need more resources, why would we accept startup equity dilution? This means we are having a burn rate in our startup.

We define burn rate as the amount of cash we are netting out from our accounts every month. Because our costs are higher than our revenue. This is fine, it’s why we are raising funds in the first place.

But all of a sudden, we have a date when the funds will run out. This is the so-called runway. We define runway in months. We can often hear startups say things like “We have an 18 months runway”. This means they are going out of business in 18 months unless they manage to raise another round.

“Plans are nothing, planning is everything.”

– Dwight D. Eisenhower

A seasoned investor will ask how we foresee the funding rounds to pan out. Even at the angel stage, investors want to know this. It can feel a bit strange to think about A-rounds when we are struggling to find a single pilot customer to pay for a trial.

But remember what Dwight D. Eisenhower said. “Plans are nothing, planning is everything.” This means that even though we know our plans will not pan out as we planned, the exercise of doing the planning will help us better understand the situation and make better decisions when the time comes.

The risk of losing control due to the dilution of your startup equity

We can maintain control of our startup without having a lot of equity. Shares of a company serve two purposes:

- Distribute the proceeds of the business

- Assert control of the company

You can separate these by having different share types. One share type can at maximum have 10x more voting power per share than another share type. Read more about different types of stocks with different voting rights.

It is not only the shares that exert control of our startup. The board of the company has the power to sign off on deals and make strategic decisions. And the shareholders (owners) appoint the board. Which makes the shareholders in control, indirectly. But how we will appoint the board, and how we will make strategic decisions, can be regulated in documents such as:

- Articles of association

- Investment agreements

- Shareholder agreements and co-founder agreements

The takeaway here is that we don’t need to maintain a majority of the shares to still be in control of our startup.

Calculating startup equity dilution when using convertibles, SAFEs, and WISEs

Above we have discussed how to calculate share dilution when we raise a fixed round. But there are other ways to raise money. Convertibles, SAFEs, and WISEs postpone the discussion about valuation to a later stage. It makes calculating the startup equity dilution a bit more complicated.

SAFEs and their equivalents are popular in Europe / US. Fixed equity rounds are more prevalent in Sweden but that trend seems to be shifting slowly. Many incubators are offering convertibles to get around the negotiation of a startup’s valuation.

To account for these instruments in your funding plan, we will have to estimate when they will convert and at what valuation. Add this amount to the round size for that stage when it converts to arrive at the dilution. However, remember that we are probably already spending that cash so it will not increase the runway.

What are then the differences between convertibles, SAFEs, and WISEs?

Convertibles are loans

I found it is easiest to think of convertibles as a loan. But with the right to convert the money lent into shares in the future. Usually with a discount on the valuation. There is almost always an interest attached to the convertible. This is increasing the amount of money that will be converted into shares when that time comes.

Convertibles usually have a cap, which is at what maximum valuation of our startup the conversion into shares will happen. The investor will never pay more than the cap but can pay less if the valuation at the round’s closing is lower.

Convertibles are a liability on the balance sheet. This means that we need to be careful how we spend that cash. If our own capital (Eget Kapital) is below half of our Share Capital (sv. Aktiekapital) we need to establish a control balance sheet (sv. kontrollbalansräkning). To get out of that situation we need to inject more capital into the company, or we will face liquidation.

SAFEs and WISEs are variants of convertibles

There is a variation of the convertible called a SAFE which was made popular by Y-Combinator. SAFEs are widely used in the world, thanks to Y-Combinator making the legal document available for everyone to use. In Sweden, there is a version of the SAFE called a WISE. If you raise money for a Swedish company, you should not use the SAFE. Use the WISE if you want the dynamics of the SAFE.

SAFEs / WISEs don’t have an interest rate, convertibles do. Same as convertibles, they have a cap. The WISE also has a floor, which is the lowest valuation a conversion into shares will happen.

WISEs do not count as a liability on the balance sheet, and you can spend the cash without the risk of having to establish a controlled balance sheet.

Takeaways

Make sure to have a plan to stay above 50% dilution as a team when the A-round is accounted for. The plan should include some padding if things don’t turn out as we hoped.

It is better to be frugal in the pre-seed stage of a startup. Raise less money and do lots of experiments. Don’t spend cash on advertising until you have proven product market fit.

SAFEs, WISEs, and convertibles need to be accounted for to understand the fully diluted cap table of a startup.