Have you heard the term SPV, or Special Purpose Vehicle, thrown around in media and wondered what an SPV is? Did you know that building a portfolio with SPVs could lead to having your returns lowered? The effect could be as much as 38% compared to investing on your own.

But there are also benefits to SPVs. Both for investors as well as startups. I’ll list the top ones below.

But let’s start with what exactly an SPV is.

Basically, it is a limited company, with the sole purpose of owning shares in ONE single startup. It’s a way for investors to syndicate when investing. The concept was popularized when Angellist made it super-easy for anyone to set up an SPV.

Let’s look at some pros and cons of an SPV as well as some other options for investing in startups.

Pros from a startup’s perspective using an SPV

Pool several smaller investors into one entity on the cap table

Pooling several smaller investors into one entity on the cap table is attractive as it simplifies overhead in investor communication. One person can then acts as the point of contact for all the other investors in the group.

Pros with an SPV from an investor’s perspective

Get access to investments through syndication that is otherwise unavailable to you

This might be the biggest pro for investing in SPVs. You might be shut out due to your ticket size being too small. Not having access to good cases is devastating for angel investors. The quality of the cases is the most important aspect of your returns. Such syndication has in recent years been popularized by Angellist.

There are other ways to leverage your way onto the cap table of promising startups. Make a case that you provide smart money. You will then have a higher chance to be accepted.

Increase the diversification of your portfolio by making smaller bets is possible with an SPV

You can make significantly smaller commitments to an SPV compared to investing directly. This might be the only way for you to allocate your funds to 20+ startups.

Provide liquidity for the specific investment

Shares in startups can be impossible or hard to sell unless there is an exit event. The ability to sell your SPV shares as a medium for the startup shares is a way around this. But be sure to check the Shareholder Agreement both in the SPV as well as in the startup to understand if transfers are allowed.

Ability to leverage your pro-rata rights in a future round when you are short of funds

Pro-rata rights are your right to defend your equity in the startup. You should always try to have pro-rata rights written in the Shareholder agreement. If the startup’s valuation is shooting through the roof you might not have the funds to exercise this right. But if the round is oversubscribed other investors might pay you to get that piece of the pie.

Cons with investing through an SPV as an investor

Paying fees to the administrator of the SPV might lower your portfolio returns by as much as 38%

This is only a con if you are the one participating in someone else’s SPV. And It depends on the terms of course. But with a carry, a long time horizon, and the nature of how returns from startup investing work, the effect compounds over time. I’ll go into details on why later in the article.

Not eligible for a tax deduction (in Sweden)

In Sweden, investments made in startups as private persons are eligible for an effective tax deduction of 15% of the invested sum. However, this does not apply to investing in holding companies according to Skatteverket.

However, a lot of angel investors handle their investments through their own limited companies. And if this is the case for you, the tax deduction is not something you do anyway.

Requires overhead if you are the administrator

It is a limited company and as such it requires to be filled and reported on. This becomes a hassle if you set them up by yourself. You will also become the point of contact between curious investors and the startup.

Could have unfavorable liquidation preferences

Depending on the terms of the SPV the owner of it might decide to pay themselves first if there is not enough money to go around in a liquidation event.

This will be a large downside for you when the company liquidates at about the same valuation as you invested. You will be last in line to get a cut of the money. Read the terms of the SPV carefully.

Why do SPV investments impact your portfolio returns so badly

It is all about the fee structure and terms. When someone sets up and handles the SPV for you they want something for this service. On top of that, they might make the terms favorable to themselves and not to you.

Let’s first look at what carry is as this has the biggest impact on the returns.

What is carry?

Carry has sneaked its way into some SPVs. A normal 20% carry means you pay 20% of the profits on the exit in the startup to the administrator of the SPV. This is before you get your payout.

That seems fair at first glance. They get paid if the startup does well. In case of no profits for you, no commission for them.

Well, I think this is not as attractive as you might think. Let me explain why.

Let’s compare this with investing in a Venture Capital fund. Then you might also pay 20% carry. I’ll get more into how VC funds work a little later in this article.

The difference with a VC fund is that you buy into a portfolio of many startups. Most of these will not do well while just a few will do extremely well. These few rocket ships will make up for the vast majority of your return.

The returns in a startup investment portfolio come from from a few rocket ships

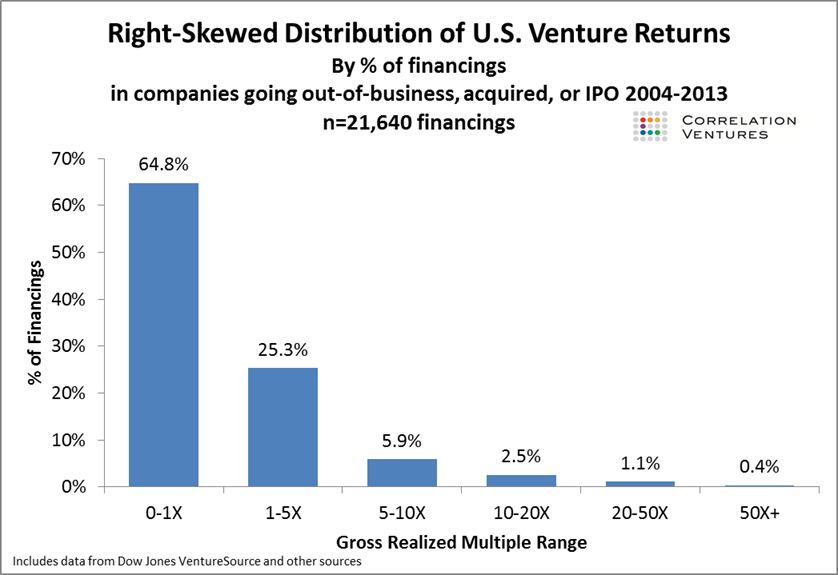

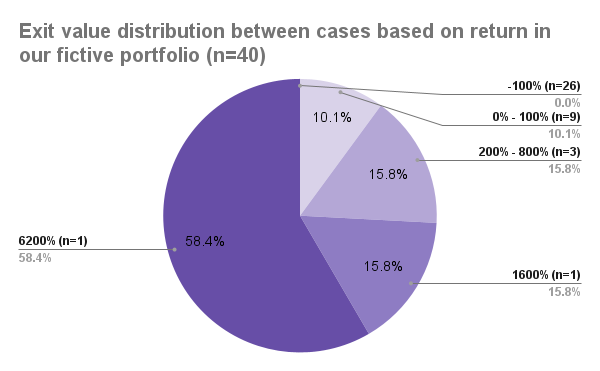

Consider the numbers from Correlation Ventures in the graph below. Around 65% of the companies did 0 – 1 times return on the money. And I suspect early angel rounds are somewhat missing in these numbers making this number of failed startups a lot higher.

So when the VC calculates the profits you would pay carry on they will subtract all the losses from the winnings before they apply their 20% carry. It’s like the income statement in a company. You can deduct your costs from your revenue before you apply the government tax.

So what does this mean for our returns?

This balancing effect on the carry fee is lost with investments in an SPV

The startups invested in giving 0 return will just be a loss to you. Non-deductible. And on the rocket ships, the startups returning 10-20-100 times or more on the money, you will have to pay 20% on the profit on them individually.

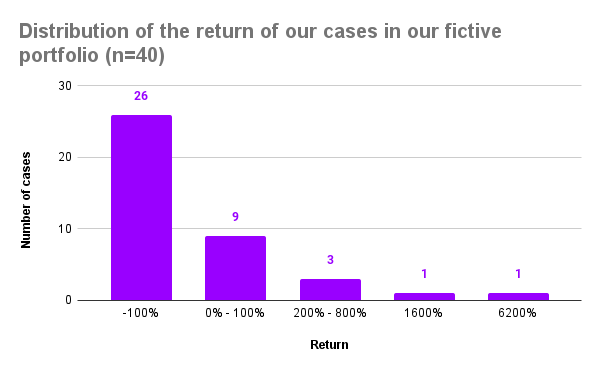

How I came up with the number of 38% lower returns from investing in SPV

Consider these conditions for an investment portfolio consisting of SPV:s:

- The time invested is 5 years

- The carry is 20% on profits

- We invest in 40 startups

- The number of investments and their return on exit is:

- 26: -100% (total loss)

- 5: 0% (we get our money back)

- 1: 12.5%

- 1: 25%

- 1: 50%

- 1: 100%

- 1: 200%

- 1: 400%

- 1: 800%

- 1: 1600%

- 1: 6200%

As shown in a graph the distribution would look like the chart below.

If we calculate the exit values and put them in relation to each other to see how much of the total return of the portfolio is provided by each segment we this chart.

The top 5 companies make up 90% of the returns

As we can see our top ONE returning case constitutes almost 60% of the total exit value. And the next ranking case adds another 15%. This means that 2 companies make up 75% of your returns. The top 5 companies make up 90%. What we see here is the Pareto Principle in action.

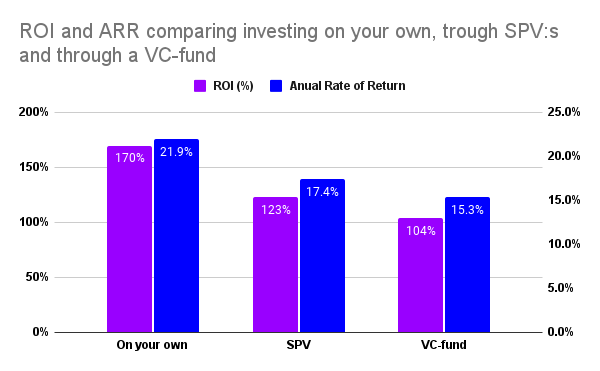

If we continue to calculate the yield of the portfolio it gives you an ROI of 170% for the 5-year period or an average annual return of 22%.

Compare this to if you invested through SPV:s with a 20% carry your ROI is 123% for the 5-year period and an average annual return of 17.5%.

That means your return is 38% higher on an annual basis if you invest on your own.

Investing in a VC fund is a passive investment

If you plug the same portfolio companies into a VC-fund case with the same carry (20%) and the standard mgmt fee (2%) per year you end up with 104% ROI for the 5 years and an annual return of 15.3%.

As we can see the returns from investing in a portfolio with SPV:s have better returns than a VC fund. But remember that investing in a VC fund is a passive investment. Their professionals will do all the hard work. With SPV:s you will have to do all the scouting and due diligence on your own.

A caveat is that a VC fund often operates on longer periods than 5 years, say 10 years, and that will increase the mgmt fee as this is deducted in advance from the total capital to be invested. There are other ways to structure mgmt fees and carry in VC funds but that’s a pretty deep rabbit hole out of scope for this article.

Keep in mind that the difference in return between investing on your own and through SPV:s keeps compounding with the time invested.

Other options to access startups and private companies

Investing passively in Private Equity through Venture Capital funds

If you got a large pile of money you can outsource your investments in Private Equity to a large fund specialized in start-up investment. Take North Zone, a player here in Stockholm, for example. In 2019 they raised a $500 MUSD fund to invest in what they call early startups.

More specifically they are looking to fund series A and B rounds and some selected seed round. That usually means the rounds are the size of at least 15 MSEK. To warrant the size of the rounds the startup has usually reached product-market fit and is ready to scale.

However, these types of funds are not accessible to invest in unless you have a large ticket to put in. I think a good rule of thumb here is that if you have not been approached or suggested by some advisor to invest in such funds you are probably not qualified.

The business model of these funds is usually pretty simple. If you invest, you lock your money up until the fund divests, somewhere around 5 – 10 years from the raising. However, you can just sit back and let the fund managers and their teams do all the hard work of managing the investments.

For this, the standard fee is a 2% management fee in the invested capital, and on top of that, a 20% carry on all the aggregated profits made from the fund. The average annual return when investing in Sequoia, one of the most famous VC funds in the world, has been 14% since its inception.

Publicly listed companies are another way to passively tap into the growth in Private Equity

Now things start to get a little bit complicated. The VC funds could be run by a company operating multiple funds and associated businesses. This company can then be listed on a public exchange.

Take EQT as an example. They have multiple funds and are listed on Nasdaq Stockholm. Anyone can buy shares in EQT and enjoy the returns generated in Private Equity. Or at least some of the returns. Listen up now, because, this is where it gets interesting.

From an investment in a company, the investors in the fund will get their return, then fees taken from operating the fund are then revenue for the Venture Capital company. Then the employees and management will take salaries and bonuses from this income. What is left after that is the profits that you will enjoy. Oh, and don’t forget the company tax they have to pay before they can pay the dividend.

This might sound a bit technical so if anything takes away this: Every time there are transactions of money between parties for an investment someone wants to get paid. This eats from your potential return.

With that said, investing in companies like EQT is a viable option for many and will give good returns over time. It is low effort and indirectly gives you access to the top investment cases and the deals are made by seasoned professionals. According to Wikipedia, EQT has 650 professionals running its operations.

Keep in mind that you also invest in the idea that the VC company itself has a good strategy, business model, and management team.

Conclusion

SPV:s can be a good way for you to build a portfolio with more startups if your capital to invest is small as they generally give you an opportunity to enter with a smaller ticket size.

SPV:s might also be the only way for you to get access to certain deals. The quality of the deals is what matters the most when angel investing. We saw that 5 out of 40 deals in our example portfolio make up 90% of our returns.

With that said, you might end up paying a high price for participating in SPVs. Building a portfolio with SPV:s that has a setup with 20% carry on profit as the only fee is likely to yield you 38% less in returns on your invested capital.